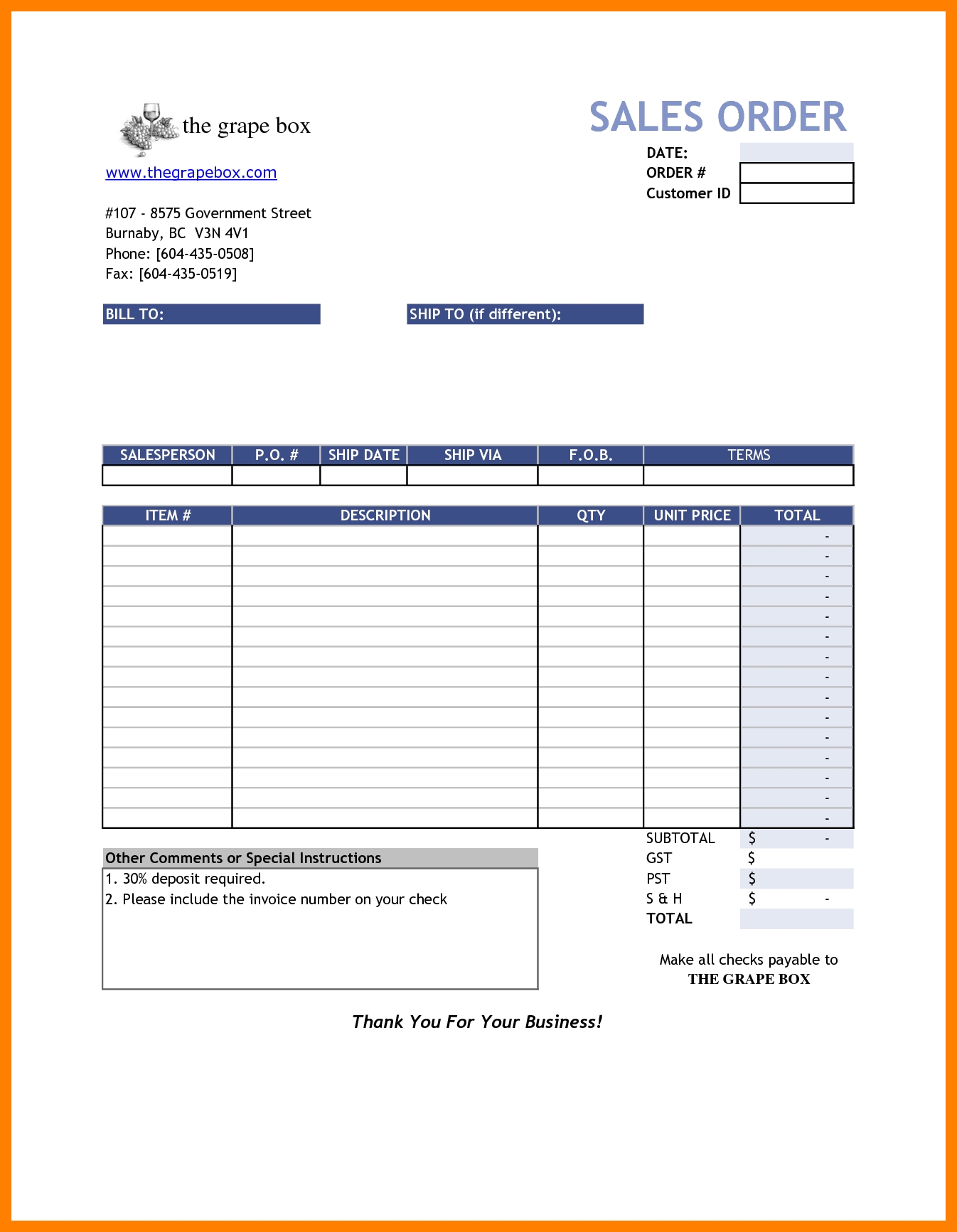

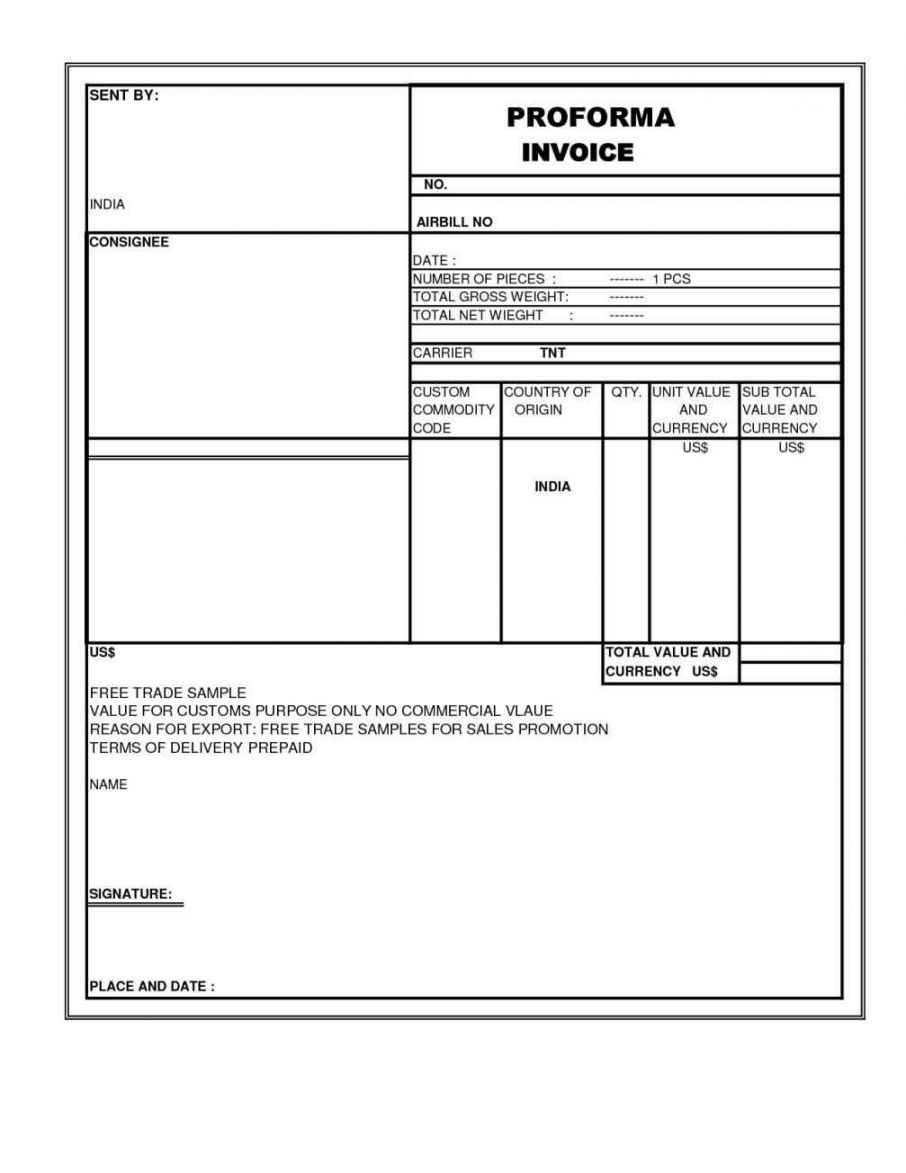

That way, the details of the work will be fresh in your mind and you should receive payment as quickly as possible. Ensure your invoice includes all the details your clients will need to pay you, including your business name, the invoice due date, and the total amount due. Invoicing software is a powerful tool that can help businesses streamline their invoicing process.

What are the rules of invoices?

Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. If you and your customer can’t reach an agreement, you may need to escalate the situation and take legal action to collect payments. There are many different invoice payment terms, so it’s important to choose the right payment terms for your business. It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. You should enter every product or service you provide as a line item on your invoices.

Best Small Business Accounting Software in 2024

Invoices are legitimate documents that can protect small businesses against missed payments for services rendered. They provide all the information you need to prove what you are owed, how to find tax records for a business which can help if you need legal help to collect payments. A formal invoice sent to a client or customer is an official record of what you provided and what your customer owes.

Why are invoices important?

With this information, businesses can choose budgeting strategies that work best for them and market appropriately throughout the following year. Choose a premade template from a gallery and tailor it so you can build your brand the way you want. Specialized SaaS (Software as a Service) companies ensure that invoicing is now automated, secure, and instant, so you can invoice on the move.

D. Itemized List of Services and Costs

Being as clear and detailed as possible helps customers better understand their total cost. By using QuickBooks, you can create electronic invoices and accept payments from one location, improving the overall transaction for your team and your clients. Find a free invoice template that’s right for your business on our free invoice templates hub. You can also use our free invoice generator to make and download custom invoices online. As a small business owner, you might be sending multiple invoices each month to customers. But when it comes to invoicing, it’s just not limited to sending invoices to your clients.

- Here are a few of the simplest and most effective, organized by format.

- It is typically compared to the buyer’s authorizing purchase order and receiving documentation (known as three-way matching) before a payment will be issued.

- It is also important to note that businesses must keep accurate records of their invoices and payments.

- The coffee shop owner would, in this case, sign a purchase order when they buy the product.

This invoice will tell the customer what they bought and how much they owe you. The final invoice lets the client know when a project is done and includes a detailed description of the services provided and total cost. Creating an invoice for your business used to be a time-consuming process. The modern world has developed the most secure, convenient, and green way of invoicing, done online through accounting and invoicing software.

Invoicing also helps businesses manage their cash flow by providing them with a clear picture of their outstanding payments and when they are due. Invoicing refers to sending an invoice or record of a transaction between a buyer and a seller. This invoice is a commercial document which records an itemized list of products or services exchanged for money, typically between a business and a customer. Invoices play a crucial role in any business, providing a reliable and organized means of tracking sales, managing client payments, and ensuring a smooth financial operation.

It’s good practice to provide a receipt when a client pays their invoice. Past-due invoices are only sent when clients exceed their final due date without paying their balance. They’re used as an effort to collect payment from non-paying accounts.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

If you’re not sure about the significance of a purchase order number, you can check out our post on What is a Purchase Order Number and its importance in business transactions. Sometimes customers may disagree with an invoice they’ve been issued. When this happens you’ll need to begin the process of resolving the invoice dispute. This starts with a conversation between you and the customer to determine which elements of the invoice the customer disagrees with.

It helps them keep track of their transactions, manage their cash flow, and ensure that they get paid for their goods or services. By following proper invoicing procedures and keeping accurate records, businesses can avoid any issues with the IRS and maintain a healthy financial position. Create and send an invoice as soon as you complete an order or service. Failing to quickly invoice clients can result in delayed payments, but timely invoicing can help you improve cash flow. Use Metrics like days sales outstanding (DSO) and the accounts receivable turnover ratio to keep track of payment speeds and your accounts receivable efficiency. Invoice numbers also contribute to maintaining an organized and accurate business accounting system.